How the Federal Reserve’s Next Move Could Impact the Housing Market: What You Need to Know

It’s September, and all eyes are on the Federal Reserve as they gear up for their next big decision. The buzz is that they’ll cut the Federal Funds Rate at their upcoming meeting. Why? Well, inflation seems to be cooling down, and the job market is slowing down (Currently there are 7.1 million unemployed people vs 6.3 million a year ago). As Mark Zandi, Chief Economist at Moody’s Analytics, puts it:

“They’re ready to cut, just as long as we don’t get an inflation surprise between now and September, which we won’t.”

But the real question is—how does this affect the housing market and, more importantly, you as a potential buyer or seller?

Why Should You Care About a Federal Funds Rate Cut?

In simple terms, the Federal Funds Rate is a key player in what happens with mortgage rates. Yes, there’s a lot more that goes into it (the economy, global events, etc.), but the Fed’s moves play a huge role.

When the Fed cuts this rate, it’s like a signal that the broader economy is adjusting, and mortgage rates tend to follow suit. Keep in mind, one cut will likely not send rates plummeting, but it definitely helps chip away at them, continuing the gradual decline we’ve been seeing.

Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Once the Fed kicks off a rate-cutting cycle, we do expect that mortgage rates will move somewhat lower.”

Fortunately, this probably won’t be a one-and-done situation. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), thinks we could be looking at six to eight rounds of cuts through 2025.

What’s the Deal with Mortgage Rates?

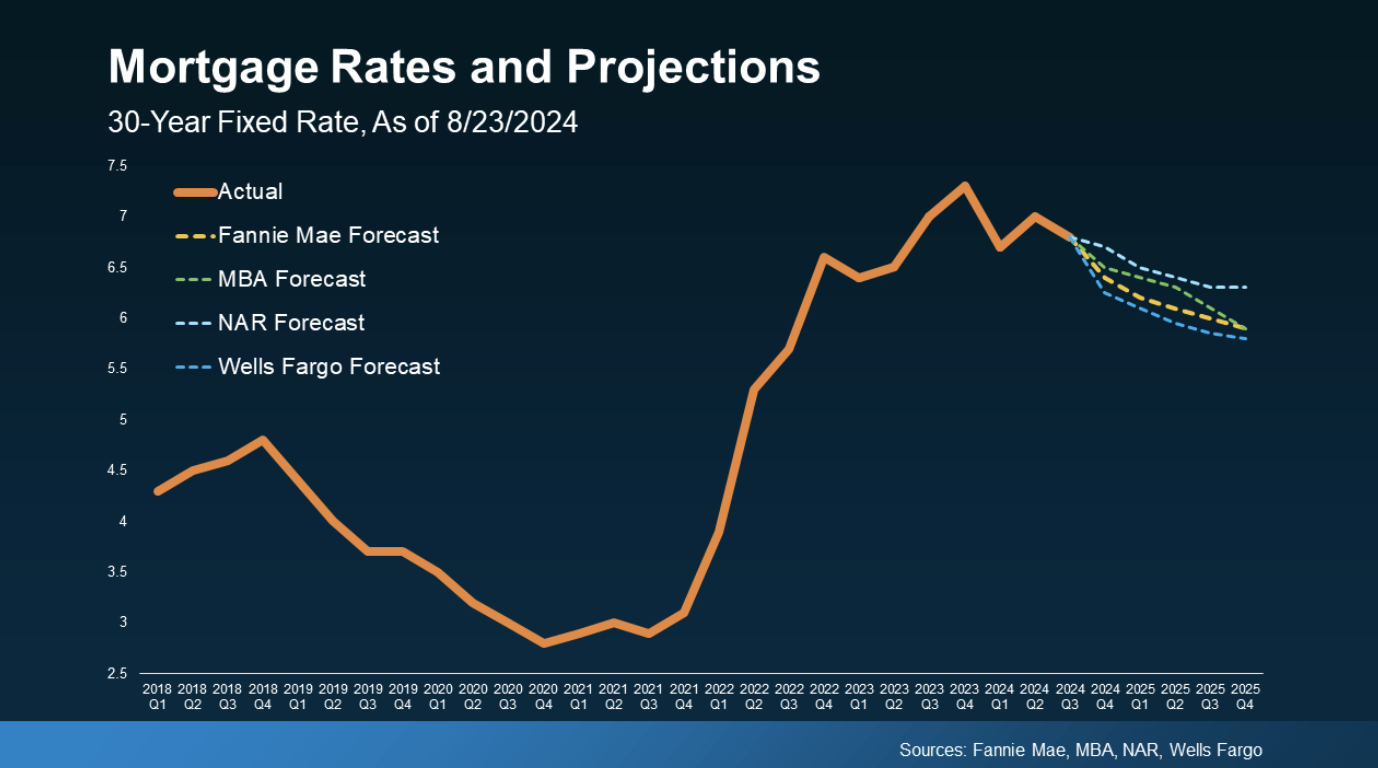

Experts from all over, like Fannie Mae, MBA, NAR, and Wells Fargo, are forecasting a steady decline in mortgage rates through 2025 due to the expected Fed cuts. With inflation easing and job growth slowing, it’s likely we’ll see mortgage rates drop, even if it’s more gradual than dramatic.

So, what does this mean for you?

1. It Might Loosen Up the “Lock-In” Effect

If you’re a homeowner, you’ve probably heard about this lock-in effect. It’s that feeling of being stuck in your current home because today’s mortgage rates are way higher than what you originally locked in.

If that’s been holding you back from selling, a small dip in rates could make the idea of moving a bit more appealing. That said, don’t expect a flood of homes hitting the market—many homeowners are still wary of giving up their attractive, low rates.

2. It’s Likely to Boost Buyer Interest

For those of you thinking about buying, even a slight drop in mortgage rates can make a big difference. It lowers the overall cost of homeownership, making it more affordable if you’ve been waiting for the right moment to jump into the market.

So, What Should You Do Next?

While a Fed rate cut probably won’t cause a huge dip in mortgage rates, it’s definitely helping nudge them in the right direction. And even though it’s a positive shift for the housing market, don’t stress too much about trying to time things perfectly. Jacob Channel, Senior Economist at LendingTree, hits the nail on the head:

“Timing the market is basically impossible. If you’re always waiting for perfect market conditions, you’re going to be waiting forever. Buy now only if it’s a good idea for you.”

Bottom Line

A potential rate cut from the Fed is likely on the horizon, driven by better inflation numbers and a cooling job market. And while it’s not going to create a sudden drop in mortgage rates, it will help push them down over time. Whether you’re thinking of buying or selling, let’s connect! That way, you’ll be ready to make your move when the time is right for you.

Feel free to book time on my calendar or reach out via phone, text, or email.